In today’s fast-paced business world, efficient budgeting and financial planning are crucial for organizational success. Let’s explore this topic in more detail with Merge Melons below. Let’s learn more about this topic below with Merge Melons, as we delve into the top office tools that can streamline your financial processes and help you make informed decisions.

The landscape of financial planning and budgeting tools has undergone a significant transformation over the years. Gone are the days when businesses relied solely on paper ledgers and basic calculators to manage their finances. The digital revolution has ushered in a new era of sophisticated software and cloud-based solutions that have revolutionized the way organizations handle their financial operations.

Traditional methods of financial planning often involved manual data entry, time-consuming calculations, and a higher risk of human error. These outdated practices not only consumed valuable time but also limited the ability to perform complex financial analyses and forecasts. However, with the advent of modern office tools, financial professionals can now leverage powerful software to automate processes, generate accurate reports, and gain deeper insights into their organization’s financial health.

The shift from traditional to digital tools has brought about numerous benefits. Digital solutions offer real-time data updates, collaborative features, and the ability to access information from anywhere with an internet connection. This flexibility has become particularly crucial in the age of remote work and global business operations. Moreover, advanced analytics capabilities embedded in these tools allow for more precise forecasting and scenario planning, enabling businesses to make data-driven decisions with greater confidence.

Read more: Best Note-Taking Tools for Office Professionals

When it comes to selecting the right office tools for budgeting and financial planning, there are several key features to consider. These features not only enhance efficiency but also provide a comprehensive view of an organization’s financial landscape.

One of the most critical aspects of modern financial planning tools is their ability to integrate data from various sources. This feature allows businesses to consolidate financial information from different departments, subsidiaries, or even external partners into a single, unified system. By centralizing data, organizations can eliminate silos and gain a holistic view of their financial position.

Advanced tools often come with built-in connectors or APIs that facilitate seamless integration with accounting software, ERP systems, and other financial databases. This integration capability ensures that all relevant financial data is automatically updated and synchronized, reducing the need for manual data entry and minimizing the risk of discrepancies.

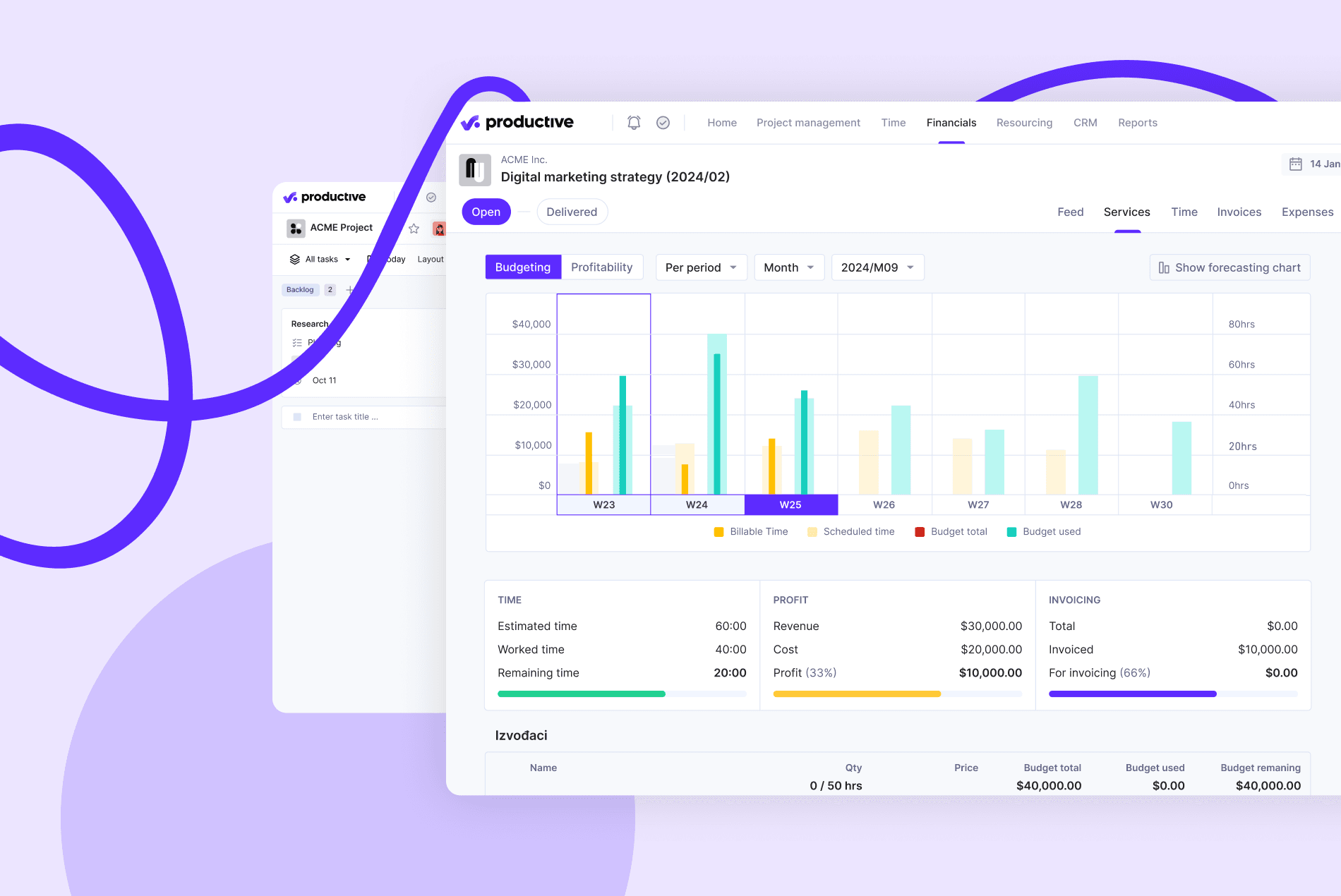

Effective financial planning requires the ability to visualize and analyze data in meaningful ways. Top-tier budgeting tools offer customizable reporting features and interactive dashboards that allow users to create tailored reports and visual representations of financial data. These tools often include a variety of chart types, graphs, and tables that can be easily configured to highlight key performance indicators (KPIs) and financial metrics.

The ability to create custom reports and dashboards enables financial professionals to present complex information in a clear and accessible manner. This feature is particularly valuable when communicating financial insights to stakeholders, board members, or executives who may not have a background in finance. By presenting data visually, these tools help facilitate better understanding and more informed decision-making across all levels of an organization.

In today’s interconnected business environment, collaboration is key to successful financial planning. Modern office tools for budgeting and financial planning often include features that support team collaboration and streamline workflows. These tools typically offer features such as shared workspaces, real-time editing capabilities, and version control to ensure that multiple team members can work together seamlessly on financial documents and plans.

Additionally, many of these tools incorporate workflow management features that help organizations define and automate approval processes, set budget constraints, and track the progress of financial planning activities. This level of collaboration and workflow management not only improves efficiency but also enhances accountability and transparency within the financial planning process.

Read more: How to Improve Office Efficiency with the Right Tech

Now that we’ve discussed the essential features to look for in budgeting and financial planning tools, let’s explore some of the top options available in the market today. These tools have gained popularity among businesses of various sizes and industries due to their robust features and user-friendly interfaces.

Microsoft Excel remains a staple in many finance departments due to its versatility and widespread familiarity. While it may seem like a traditional tool, Excel has evolved significantly over the years, offering advanced features for financial modeling, data analysis, and visualization. When combined with Microsoft Power BI, Excel becomes an even more powerful tool for creating interactive dashboards and reports.

Excel’s strength lies in its flexibility, allowing users to create custom formulas, macros, and templates tailored to their specific financial planning needs. The addition of Power Query and Power Pivot features has further enhanced Excel’s data manipulation and analysis capabilities. For organizations already using Microsoft Office suite, Excel and Power BI provide a cost-effective solution for budgeting and financial planning.

For businesses seeking a comprehensive, cloud-based solution, Oracle NetSuite Planning and Budgeting offers a robust set of tools designed to streamline financial planning processes. This platform provides features such as driver-based planning, rolling forecasts, and what-if scenario modeling, allowing organizations to create more accurate and dynamic financial plans.

One of the key advantages of NetSuite Planning and Budgeting is its seamless integration with other NetSuite modules, providing a unified platform for financial management, ERP, and CRM. This integration ensures that financial planning is closely aligned with other business operations, fostering a more holistic approach to organizational management.

Anaplan has gained recognition as a leading platform for connected planning, offering a flexible and scalable solution for budgeting and financial planning. Its cloud-based architecture allows for real-time collaboration across departments and enables organizations to create complex financial models that can adapt to changing business conditions.

One of Anaplan’s standout features is its in-memory calculation engine, which allows for rapid processing of large datasets and complex calculations. This capability is particularly valuable for organizations dealing with high volumes of financial data or those requiring frequent updates to their financial models. Additionally, Anaplan’s user-friendly interface and drag-and-drop functionality make it accessible to both finance professionals and business users, promoting wider adoption across the organization.

As technology continues to evolve, so do the capabilities of budgeting and financial planning tools. Several emerging trends are shaping the future of these office tools, offering new possibilities for enhanced financial management and decision-making.

The integration of artificial intelligence (AI) and machine learning (ML) into financial planning tools is revolutionizing the way organizations approach budgeting and forecasting. These advanced technologies can analyze vast amounts of historical and real-time data to identify patterns, trends, and anomalies that might be overlooked by human analysts.

AI-powered tools can generate more accurate financial forecasts by considering a wider range of variables and adjusting predictions based on real-time market conditions. Machine learning algorithms can also improve over time, learning from past forecasts and actual results to refine their predictive capabilities. This level of intelligence not only enhances the accuracy of financial planning but also frees up finance professionals to focus on strategic analysis and decision-making rather than data crunching.

Some AI-driven features in modern financial planning tools include:

. Automated anomaly detection to identify unusual transactions or budget variances

. Predictive analytics for sales forecasting and revenue projections

. Natural language processing for generating narrative reports and insights

. Intelligent cash flow forecasting based on historical patterns and external factors

While data visualization has been a key component of financial planning tools for some time, the latest trend is towards more advanced and interactive visualizations that tell a compelling story. Modern tools are moving beyond static charts and graphs to offer dynamic, interactive dashboards that allow users to explore financial data in depth.

These advanced visualization capabilities enable finance professionals to present complex financial information in a more engaging and understandable format. By incorporating elements of data storytelling, these tools help to communicate the narrative behind the numbers, making it easier for stakeholders to grasp key insights and make informed decisions.

Some innovative features in this area include:

. Interactive drill-down capabilities that allow users to explore data at various levels of granularity

. Customizable dashboards that can be tailored to different user roles or departments

. Scenario comparison tools that visually represent the outcomes of different financial strategies

. Geospatial visualizations for organizations with multiple locations or global operations